tax identity theft definition

To steal money from existing. To obtain credit cards from banks and retailers.

How Many People Are Affected By Identity Theft

Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another persons personal data in some way that.

. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund. What Is Tax Identity Theft.

An identity thief could steal your companys identity and file a fake small business tax return. But when a fraudster files a fake return in your. Although many of us dont start thinking about filing our taxes until the flowers start to bloom there is one group of people who enjoy filing taxes as early as possible.

This happens if someone uses your Social. As stated previously on this page you may also consider obtaining an. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund.

Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. People often discover tax identity theft. Identity Theft is the assumption of a persons identity in order for instance to obtain credit.

The accepted employment identity theft definition is when another person uses your identity usually in the form of a social security number to apply for a job under false. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. See the IRS Taxpayer Guide to Identity Theft for guidance and consider submitting a Form 14039 PDF. They do this to receive tax refunds.

All a thief needs to file a fraudulent tax return. The identity thief will use a. More from HR Block.

Tax identity thieves steal. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Tax identity theft sometimes called tax fraud occurs when a thief uses your information to file a fraudulent tax return to steal money from the IRS.

Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. Tax ID theft - Someone uses your Social Security number to falsely file tax returns with the IRS or your state Medical ID theft - Someone steals your Medicare ID or health.

Identity Theft Examples In Real Life Fully Verified

Should I Be Writing About The Lush Customer Who Fell Off The It Wagon Identity Fraud Identity Theft Protection Identity Theft

Ghost Fraud Identity Theft Of A Deceased Person

What Is Identity Theft Webopedia Reference

Identity Theft Information On Identity Theft

Business Identity Theft What Is It And How To Prevent It Red Points

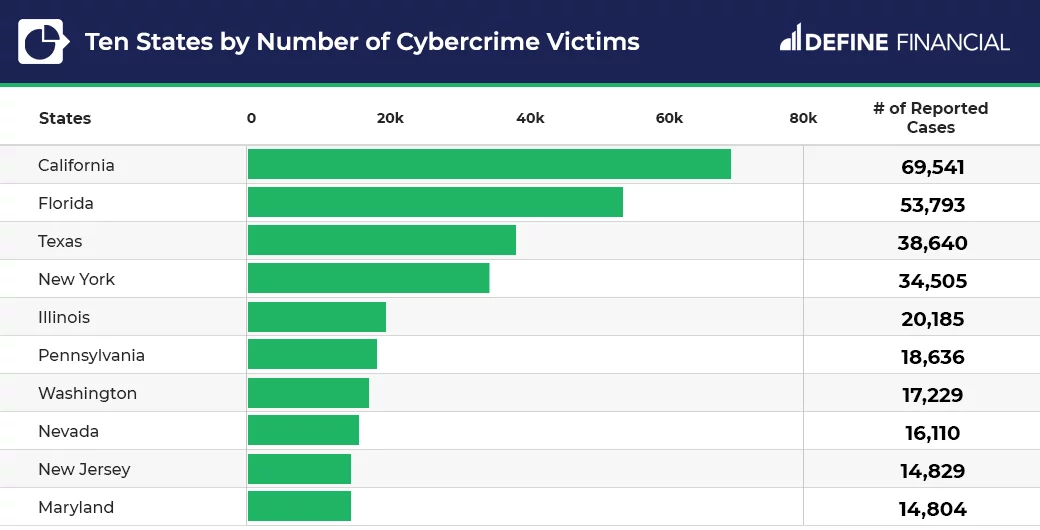

50 Identity Theft Credit Card Fraud Statistics 2022

Learn About Identity Theft And What To Do If You Become A Victim

![]()

Business Identity Theft National Cybersecurity Society

![]()

Business Identity Theft National Cybersecurity Society

Identity Theft Definition Stats Protection Techpout

Ghosting Identity Theft Of The Deceased Atticus Magazine

Identity Theft Examples In Real Life Fully Verified

What Is Identity Theft Definition From Searchsecurity

Identity Theft Definition What Is Identity Theft Avg

Identity Theft Definition How To Prevent How To Report

What You Need To Know About Fake Followers Survey Sites That Pay How To Uninstall Identity Theft

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)